Special journals (in the field of accounting) are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases. Additionally, cash receipt journals can also help with cash payments that may be on an accrual basis while providing detailed lists of all the cash the company receives. Many businesses enjoy the benefits of a cash receipts journal as depending on the business, a large portion of their customers may prefer to use cash.

Bookkeeping

- Because the cash book is updated continuously, it will be in chronological order by transaction.

- The three column cashbook uses three columns on each side of the book.

- The second type of cash book is called the double-column cash book.

It has a total record of all the cash collections during an accounting period. The information recorded in the cash receipt journal is used to make postings to the subsidiary ledgers and to relevant accounts in the general ledger. It is important to realize that the cash receipt journal is a book of prime entry.

Turn business receipts into data & deductibles

They contain detailed records of business transactions and are used for reconciling accounts and transferring information to other accounting records. These records can include transaction amount, account name, receivable ledger, receivable account, and more. Assuming your business sells inventory to someone for the sales price of $1,000 then you would need to record this entry. Any time cash is received, it would be a debit to cash, as this is the normal balance of the account.

Cash Payments

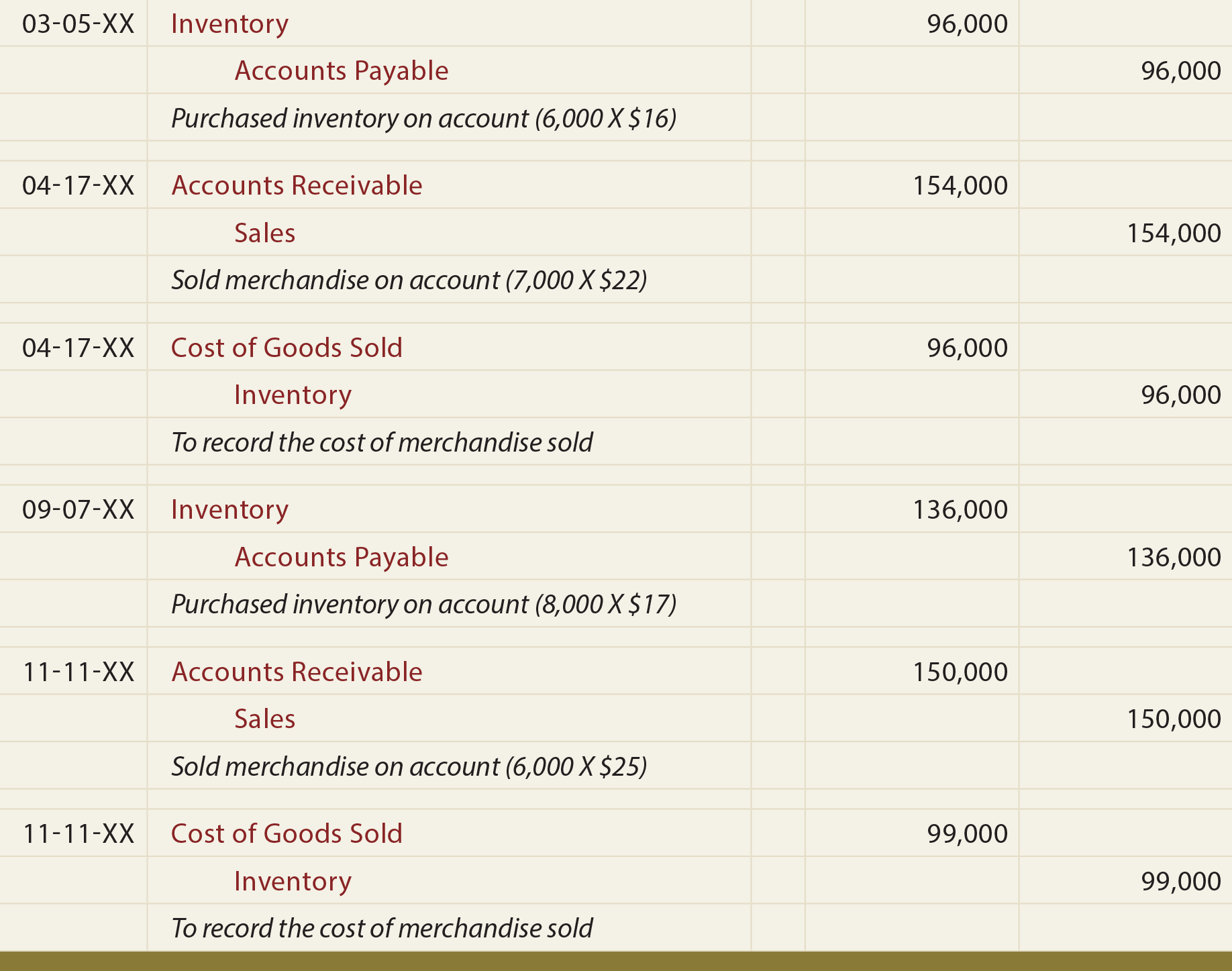

This entry records the amount of money the customer owes the company as well as the revenue from the sale. In reality, accounting transactions are recorded by making accounting journal entries. Just like everything else in accounting, there’s a particular way to make an accounting journal entry when recording debits and credits. Double entry system of bookkeeping says that every transaction affects two accounts. There is a proper procedure for recording each financial transaction in this system, called as accounting process.The process starts from journal followed by ledger, trial balance, and final accounts. At the end of each accounting period (usually monthly), the cash receipts journal column totals are used to update the general ledger accounts.

To make sure your books are as accurate as possible, make sure you organize business receipts using a storage system (e.g., filing cabinets or computer). Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Income Statement Under Absorption Costing? (All You Need to Know)

Your cash receipts journal manages all cash inflows for your business. In terms of details, the journal entry would include additional information such as a date column, amount total, account number (if applicable), and so on. The store can issue similar cash receipts to its business customers when receiving cash. All additional cash sources, including bank interest, investment maturities, sales of non-inventory assets, sales of fixed assets, etc.

As the business is using subsidiary ledger control accounts in the general ledger, the postings are part of the double entry bookkeeping system. All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received. Therefore, a credit is needed for one or more other accounts that are affected by collecting cash.

In the cash receipts diary, all funds received from clients that fall under cash sales for goods and services are noted along with the counterparty’s name in the narration. Depending on a company’s requirements, different formats are used for a cash receipts journal. To help you understand the recording procedure, a simple format is given below. Again, the three column cash ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. The other side of the cash book has the heading ‘Credit’ and shows an identical format with the single column representing the monetary amount of the cash payment.

Making entries in a cash receipts journal is a pretty simple and straightforward process. As previously mentioned, cash receipt journals record the inflow of cash from any source. Manual accounting systems will likely use special cash receipt journal entry journals for recording routine transactions. Therefore, the general journal will have a limited amount of entries. Accounting principles help govern the world of accounting according to general rules and guidelines.