The higher the degree of operating leverage, the greater the potential danger from forecasting risk, in which a relatively small error in forecasting sales can be magnified into large errors in cash flow projections. The degree of financial leverage is a more mainstream ratio used by businesses for accessing the sensitivity of earnings per share by the change in the EBIT. A financial ratio measures the sensitivity of a firm’s EBIT or operating income to its revenues. The downside is that profits are limited since costs are so closely related to sales.

What does a high DOL indicate?

In the base case, the ratio between the fixed costs and the variable costs is 4.0x ($100mm ÷ $25mm), while the DOL is 1.8x – which we calculated by dividing the contribution margin by the operating margin. Whereas the low measure of DOL shows a high ratio of variable costs. The firm doesn’t need to increase its sales to cover high fixed costs. A low DOL occurs when variable costs make up the majority of a company’s costs.

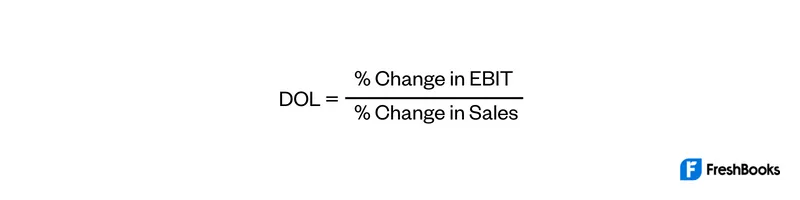

Formula for Operating Leverage

- One important point to be noted is that if the company is operating at the break-even level (i.e., the contribution is equal to the fixed costs and EBIT is zero), then defining DOL becomes difficult.

- If a company expects an increase in sales, a high degree of operating leverage will lead to a corresponding operating income increase.

- This is because small changes in sales can have a large impact on operating income.

- However, if sales fall by 10%, from $1,000 to $900, then operating income will also fall by 10%, from $100 to $90.

- Yes, industries that are reliant on expensive infrastructure or machinery tend to have high operating leverage.

We will need to get the EBIT and the USD sales for the two consecutive periods we want to analyze. In this case, it will be the 1st quarter, 2020 and the2nd quarter, 2020. For the particular case of the financial one, our handy return of invested capital calculator can measure its influence on the business returns. This means that EBIT varies in direct proportion to the sales level. These two costs are conditional on past demand volume patterns (and future expectations).

The Operating Leverage Formula Is:

Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue. A business that generates sales with a high gross margin and low variable costs has high operating leverage. Operating leverage, or Degree of Operating Leverage (DOL), measures how your operating income is affected by your fixed costs, variable costs and your sales volume. Companies with high fixed costs relative to variable costs will exhibit high operating leverage, meaning their earnings are more volatile with changes in sales. This can be beneficial in periods of rising sales but risky when sales decline.

What is your risk tolerance?

Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output. For example, Company A sells 500,000 products for a unit price of $6 each. In other words, operating leverage is the measure of fixed costs and their impact on the EBIT of the firm. Operating leverage and financial leverage are two very critical terms in accounting.

What is the approximate value of your cash savings and other investments?

A 10% increase in sales will result in a 30% increase in operating income. A 20% increase in sales will result in a 60% increase in operating income. Consequently it also applies to decreases, e.g., a 15% decrease in sales would result to a 45% decrease in operating income. The degree of operating leverage (DOL) measures how much change in income we can expect as a response to a change in sales.

In contrast, a computer consulting firm charges its clients hourly and doesn’t need expensive office space because its consultants work in clients’ offices. This results in variable consultant wages and low fixed operating costs. Businesses with high fixed costs are prone to large fluctuations in operating profit in response to small changes in sales. DOL is closely linked with degree of financial leverage, which measures the interest burden; and degree of total leverage, which measures the combined burden of fixed costs and interest costs. A high degree of operating leverage indicates that the majority of your expenses are fixed expenses. Though high leverage is often viewed favorably, it can be more difficult to reach a break-even point and ultimately generate profit because fixed costs remain the same whether sales increase or decrease.

This means that the more fixed costs that a company has, the more sales it has to generate to earn a profit. Operating leverage occurs when a company has fixed costs that must be met regardless of sales volume. When the firm has fixed costs, the percentage change in profits due to changes in sales volume deleting invoices and bills in xero part 2 is greater than the percentage change in sales. With positive (i.e. greater than zero) fixed operating costs, a change of 1% in sales produces a change of greater than 1% in operating profit. The bulk of this company’s cost structure is fixed and limited to upfront development and marketing costs.

If the composition of a company’s cost structure is mostly fixed costs (FC) relative to variable costs (VC), the business model of the company is implied to possess a higher degree of operating leverage (DOL). This is actually caused by the “amplifying effect” of using fixed costs. Even if sales increase, fixed costs do not change, hence causing a larger change in operating income. If sales revenues decrease, operating income will decrease at a much larger rate. Conversely, Walmart retail stores have low fixed costs and large variable costs, especially for merchandise. Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase.