5 Office space was rented for July, and $ 5,000 was paid for the rental. 10 Collections were made for the services performed on August 6, $ 3,200. 31 Received an order for services at $ 12,000.

Introduction to Accounting

Increasing a liability is recorded with a credit. Cash is not paid yet so it will not be used in the journal entry. Received $150,000 cash from investors for ownership in the company.b.

SHORT ANSWER QUESTIONS, EXERCISES AND PROBLEMS

Feel free to refer back to the examples above should you encounter similar transactions. The company received supplies thus we will record a debit to increase supplies. By the terms “on account”, invoice templates in adobe illustrator it means that the amount has not yet been paid; and so, it is recorded as a liability of the company. Each asset, liability, owner’s equity, revenue, and expense account gets a “T” account.

Journal Entry for Asset Purchase

Hence, debit the Profit and loss appropriation A/C and credit Interest on capital A/C at the time of transferring Interest on Capital. Example Part 2 – 2,000 rent received in the previous month to be adjusted this month. Step 2 – Adjustment entry when the prepaid expense expires. The practice of allowing discounts to customers on goods purchased. When a business commences and capital is introduced in form of cash. Feb. 25 Received payment of $ 4,400 for remodeling a basement into a recreation room.

- You should have written a T account for each account name used, posted the amounts on the proper debit or credit side and balanced each account.

- Seek information on the advantages and disadvantages of working for a CPA firm.

- Paying later increases a liability which is done with a credit (b).

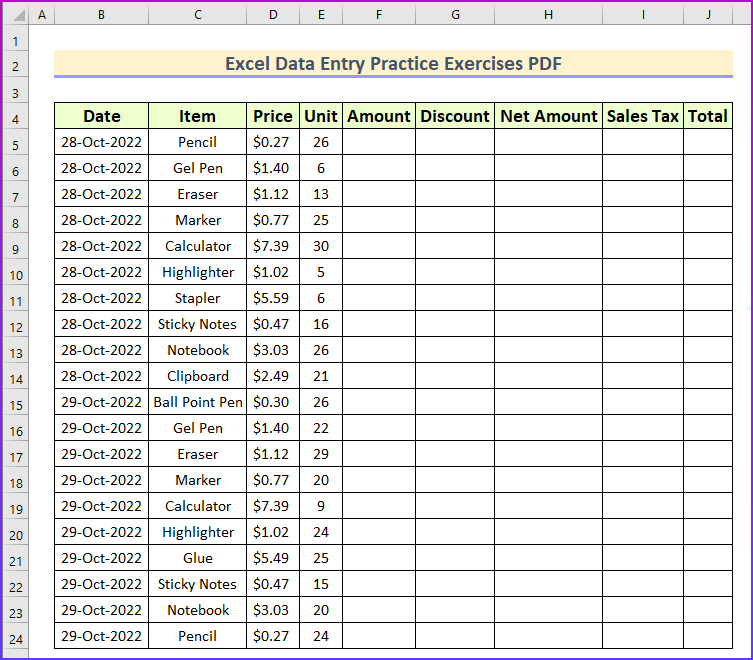

Basic Accounting Journal Entries Exercise

B. Accumulated depreciation is the account that is always credited when recording depreciation expense. This account is the total of all prior years’ depreciation expense. Accumulated depreciation is a contra asset account which means it is opposite of an asset.

Exercise G Using your answer for the previous exercise, prepare a trial balance. Assume the date of the trial balance is March 31. Exercise F Using the data in the previous problem, post the entries to T-accounts. Write the letter of the transaction in the account before the dollar amount. He is the sole author of all the materials on AccountingCoach.com.

Assets are credited when they are decreased. Accounts receivable decreases when the customer pays the company. (a.) & (c.) are recorded with a debit to accounts receivable. A. Record journal entries for the above transactions B. Make a “T” account for the cash account, post the journal entry amounts in the T account, and balance the cash account.

As a team, write a memorandum to the instructor summarizing the results of the interview. The heading of the memorandum should contain the date, to whom it is written, from whom, and the subject matter. Apr. 10 Received $ 7,000 for converting a room over a garage into an office for a college professor.