The norms of normal costs are the costs that usually occur at a given level of output, under the same set of conditions in which this level of output happens. So the classification follows the pattern of basic managerial activities of the organization. Cost accounting is helpful because it can identify where a company is spending its money, how much it earns, and where money is being lost.

Direct Costs and Indirect Costs

All manufacturing costs (direct materials, direct labor, and factory overhead) are product costs. Direct costs – those that can be traced directly to a particular object of costing such as a particular product, department, or branch. Some operating expenses can also be classified as direct costs, such as advertising cost for a particular product. The full costs include business costs, opportunity costs, and normal profit.

Alternatives to Frog Cremation Urns

Indirect materials and indirect labor are also included in factory overhead. Costs incurred in the production process, including direct materials, direct labor, and manufacturing overhead. Operating costs are day-to-day expenses, but are classified separately from indirect costs – i.e., costs tied to actual production. Investors can calculate a company’s operating expense ratio, which shows how efficient a company is in using its costs to generate sales. Indirect expenses are those which are incurred by the organization in carrying out their total business activities and cannot be conveniently allocated to job, process, cost unit or cost centre. Rent, rates, taxes, insurance, lighting, telephone, postage and telegrams, depreciation etc. are the examples of indirect expenses.

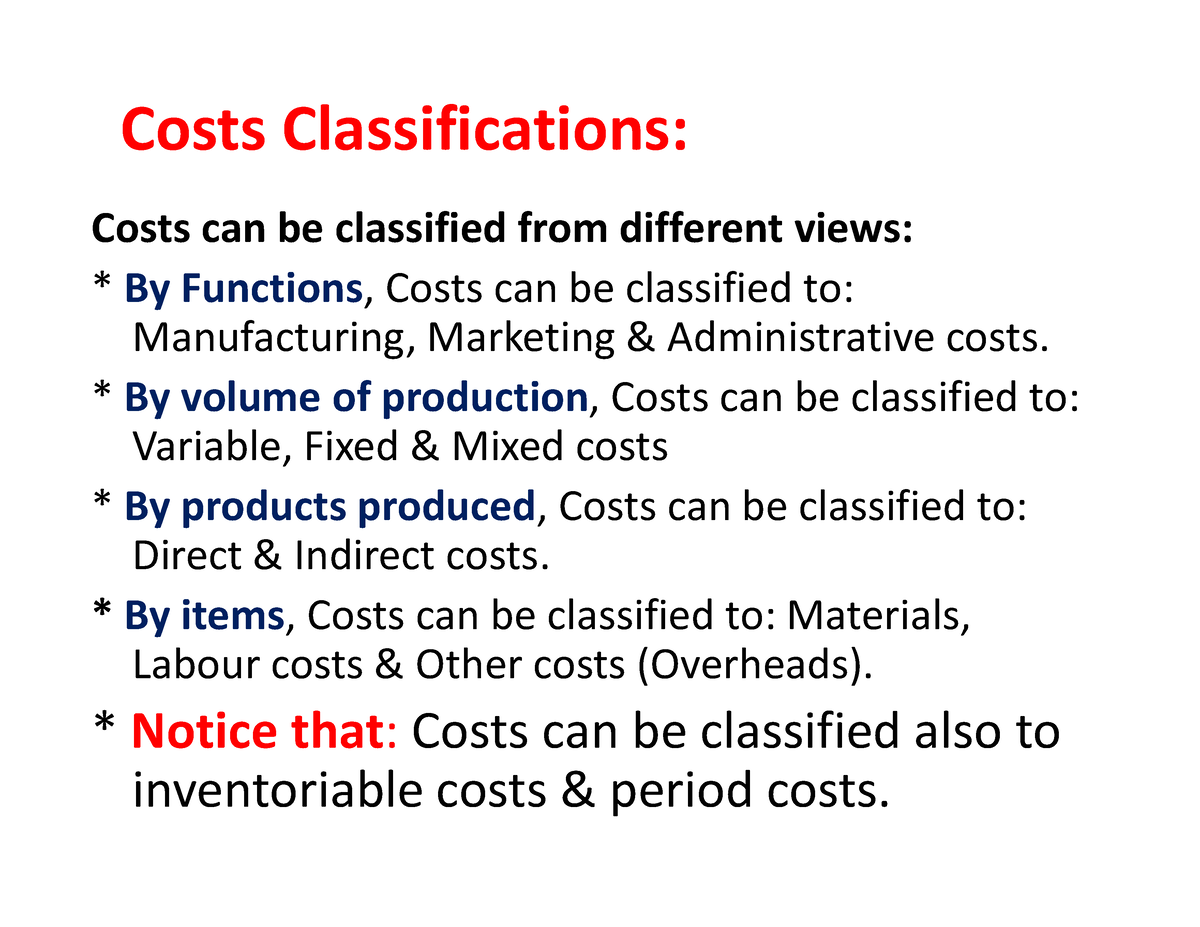

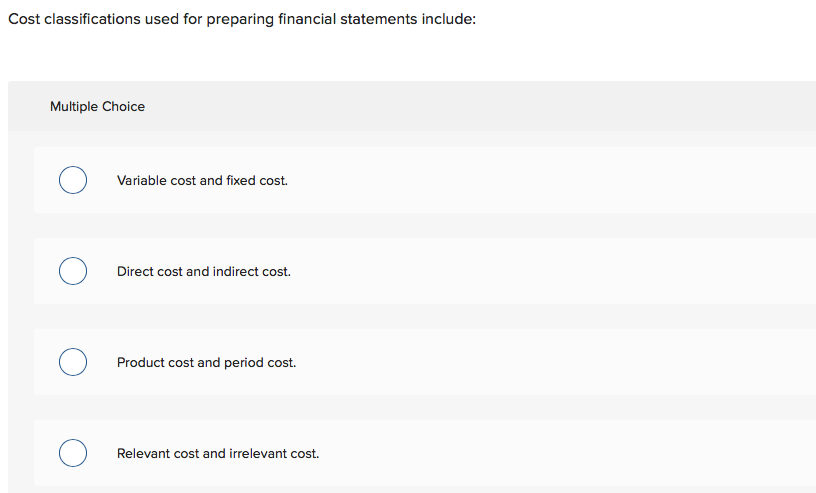

Types of costs Cost classifications

Another popular design element is the incorporation of nature-inspired motifs, such as leaves, vines, or water features. These elements can evoke the natural habitats that frogs thrive in, creating a serene and peaceful resting place. Some frog urns also feature personalized engravings or inscriptions, allowing you to immortalize your frog’s name, a cherished memory, or a heartfelt message. Annually, rises in living costs across all household types were lower than the rises in the June 2024 quarter. Employee households’ living costs rose 0.6 per cent this quarter, around half the 1.3 per cent increase last quarter. Opportunity cost may be defined as the return from the second-best use of the firm’s limited resources, which it forgoes in order to benefit from the best use of these resources.

Activity-based costing is a system that is combined with the other two methods to identify and measure costs more specifically. When the production process is such that goods are produced from a sequence of continuous or repetitive operations or processes, the cost incurred during a period is considered as process cost. The process cost per unit is derived by dividing the process cost by number of units produced in the process during the period. The average cost per unit produced during the period is process cost per unit. The future costs are costs expected to be incurred at a later date and are the only costs that matter for managerial decisions because they are subject to management control.

- These indirect labour costs cannot be identified with any particular job, process, cost unit or cost centre.

- If you’re drawn to the idea of a more interactive memorial, you could explore the option of a frog-themed garden or habitat.

- Explicit costs, also referred to as actual costs, include those payments that the employer makes to purchase or own the factors of production.

- Abandonment cost refers to the cost incurred in abandoning a fixed asset (i.e., the cost that cannot be recovered or salvaged from the abandoned asset).

What Are the Types of Costs in Cost Accounting?

It refers to any kind of change like add or drop a new product/existing product, changing distribution channels, add or drop business segments, adding new machinery, sell or process further, accept or reject special orders etc. It is used in decision making and selection of alternative with maximum profitability. Its main purpose is to provide basis for control through variance accounting for the valuation of stock and work-in-progress and in some cases, for fixing selling prices. A standard cost is a planned cost for a unit of product or service rendered. Costs reported by conventional financial accounts are based on historical valuations. But during periods of changing price levels, historical costs may not be correct basis for projecting future costs.

A direct cost is a cost that can be traced to specific segments of operations. Product costs are assigned to goods either purchased or manufactured for resale; they are incurred to produce or purchase a product. Product costs are initially identified as part of the inventory on hand. how to convert a money factor to an interest rate Furthermore, various cost concepts and measurement techniques are needed for internal planning and control. Revenues from each of the channels come after deducting the cost from sales. Controllable costs – refer to costs that can be influenced or controlled by the manager.

Escalation clause is sometimes provided in the contract in order to take care of anticipated change in material price, labour cost etc. The postponable cost is that cost which can be shifted to the future with little or no effect on the efficiency of current operations. These costs can be postponed at least for some time, e.g., maintenance relating to building and machinery. The implicit cost is a cost which doesn’t involve actual cash outlay, which are used only for the purpose of decision making and performance evaluation. No actual payment of interest is made but the basic concept is that, had the funds been invested elsewhere they would have earned interest.

The attention to detail in these custom-made urns can be truly breathtaking, serving as a stunning and lasting tribute to your beloved frog. At the more affordable end of the spectrum, you can find basic frog urns made from materials like ceramic or resin, typically priced between $50 and $150. These simple yet elegant designs often feature basic frog motifs or inscriptions, providing a dignified resting place for your beloved amphibian.

Period costs are recognized in the income statement as an expense at the time they are incurred. In contrast to general accounting or financial accounting, cost accounting is an internally focused, firm-specific method used to implement cost controls. Cost accounting can be much more flexible and specific, particularly when it comes to the subdivision of costs and inventory valuation.