‘Inc.’ in a company name means the business is incorporated, but what does that entail, exactly? After you take depreciation in the fifth year, your asset will be worth its salvage value—$30,000. Founded in 2017, Acgile has evolved into a trusted partner, offering end-to-end accounting and bookkeeping solutions to thriving businesses worldwide. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

- The only guideline is that the depreciation method should be systematic and rational, and as we noted, all of the depreciation methods discussed so far meet this requirement.

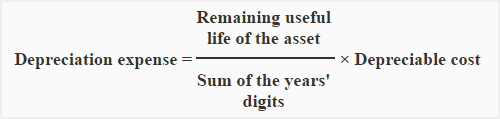

- To calculate depreciation charges using the sum of the years’ digits method, you’ll need to first get the depreciable base, which is the cost of the asset.

- Notice that the depreciation is highest in the first year and is declining each year which means that the sum of the years digits depreciation is an accelerated depreciation method.

Great! The Financial Professional Will Get Back To You Soon.

The-years’-depreciation is an accelerated method of depreciation that provides higher depreciation in the early years of the asset’s life and lower depreciation in the later years. A specific formula is used to calculate the depreciation for each year; salvage value is included in the calculation. See also straight-line depreciation and declining balance depreciation and units? The sum of the years digits depreciation method (SYD depreciation) is used to calculate the annual depreciation expense of a fixed asset.

How the SYD Method Works?

The company decides to depreciate the assets using the SYD method as it faces a fairly harsh tax environment. Also, there is a high probability that the computers will become obsolete before their useful life is up. Create a depreciation schedule to model how these assets can be depreciated. The sum of years method of depreciation is also popular with firms that are looking to write off equipment that has a high probability of becoming obsolete before the salvage value is reached.

Microsoft® Excel® Functions Equivalent: SYD

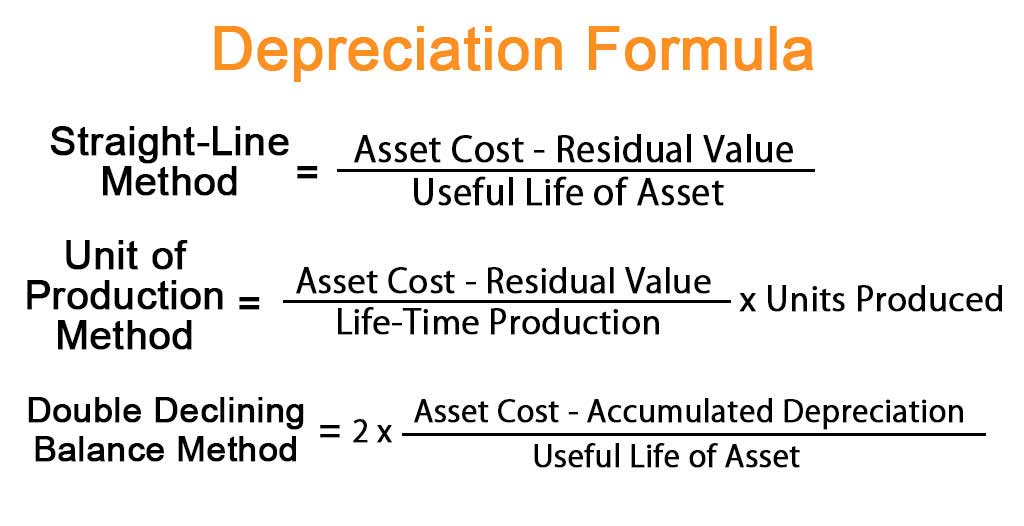

Most common methods are the straight line method or the declining balance method. In this article, we will define this calculation method, show how it works and end with an example. As an asset gets older, repair and maintenance costs rise as the asset needs repairs more often; again, consider an automobile as an example. As the depreciation rate decreases over time, so does the depreciation charge. Accelerated depreciation uses decreasing charge methods, including the sum-of-the-years’ digits (SYD), providing higher depreciation costs in earlier years and lower depreciation charges in later periods.

What Is the Simplest and Most Commonly Used Method of Depreciation?

There will be 5 entries at the end of each year where the company debits the depreciation expense and credits the accumulated depreciation account. The sum of the years method assumes that the productivity of the asset is the highest in the initial years and goes on decreasing in the subsequent years. It considers an even amount for depreciation across the fruitful life of an asset.

Since the useful life of the truck is four years, we need add all numbers that fall between 4 and zero to find the sum. An asset’s depreciation base is its initial cost, minus any salvage or residual value at the end of its useful life. CCC just acquired a truck for $60,000 and estimates that the truck will be useful for 6 years with a remaining salvage value of $5,000. It should be noted that the depreciation rate obtained with the formula above will sum up to 100% when adding the percentage obtained for each year.

This approach is particularly useful for assets that lose value quickly or have higher utility in their initial years, such as vehicles, technology, and machinery. After all, the company should try to match the expense coming from the depreciation of the fixed asset with the actual home office expenses vs the simplified method benefits that it provides to the company. As mentioned, using the sum of years digits depreciation of the fixed assets will make the depreciation expense that the company charged to the income statement higher in the early year, and such expense will go down as time passes.

Sum of the Years’ Digits Method involves finding the sum of all digits between zero and the number of years in the asset’s useful life. Depreciation expense under this method is calculated by multiplying the depreciable cost of an asset by the fraction of its remaining useful life and the sum of its years’ digits. The Sum-of-the-Years’ Digits (SYD) method is a form of accelerated depreciation used to allocate the cost of an asset over its useful life. Unlike the straight-line method, which spreads the cost evenly over the asset’s life, SYD front-loads the depreciation expense, resulting in higher charges in the earlier years and lower charges in the later years.

In order to help you advance your career, CFI has compiled many resources to assist you along the path.

The best examples or scenarios where applying this method is fruitful can be automobiles, computers, mobile phones. A newer model of a car or the latest technological advent can lead to quick obsolescence of these assets. It must be noted that the final depreciation expense equals the salvage value of the asset. Our example assumes ABC technologies that purchased computers for $4,000,000. Considering the useful life of the computers to be 5 years and a salvage value of $100,000.

The numerator will be the digit of each year, starting with the last year of life expectancy. Accelerated depreciation allows for the likelihood of assets to decline over time, and also to require higher repair and maintenance costs in later years than when first purchased. Therefore, a decreasing depreciation charge will help balance the cost of maintenance of the asset. There are multiple steps involved in calculating the sum of the years’ digits. For the calculation, you will need to know the total useful life of the asset. The useful life is how long you expect the asset will be useable before it is fully depreciated.