From there, gross profit is impacted by other operating expenses and income, depending on the nature of the business, to reach net income at the bottom — “the bottom line” for the business. You’ve added $1,000 to your retained earnings by saving more cash, even though your liabilities haven’t changed. These transactions also include wages, income tax payments, interest payments, rent, and cash receipts from the managerial finance sale of a product or service. Expenses that are linked to secondary activities include interest paid on loans or debt. Use the formula above to help calculate your retained earnings balance at the end of each period.

Your liabilities can either be current (short-term) or noncurrent (long-term). Some examples of liabilities include accounts payable, accrued expenses, and long-term loan debt. Investors, lenders, and vendors might be interested in checking out your business’s cash flow statement. Read on to learn the order of financial statements and which financial statement is prepared first.

- The cash flow statement tells you how much cash you collected and paid out over the year.

- Equity can also consist of private or public stock, or else an initial investment from your company’s founders.

- Expenses could be various operating costs, like inventory, rent, or utilities.

- Investors and lenders can use this information to get a more detailed and comprehensive picture of a company’s financial health.

- Use your net profit (or net loss) from your income statement to prepare your statement of retained earnings.

- The accounting cycle incorporates all the accounts, journal entries, T accounts, debits, and credits, adjusting entries over a full cycle.

The Four Accounting Statements Required By GAAP Are Prepared In A Certain Order. What Is The Order?

When it comes to financial reporting, accuracy and consistency are of utmost importance. Companies follow certain guidelines and standards to ensure that their financial statements provide an accurate understanding of their financial position and performance. In the United States, the Generally Accepted Accounting Principles (GAAP) is the standard framework used for financial accounting.

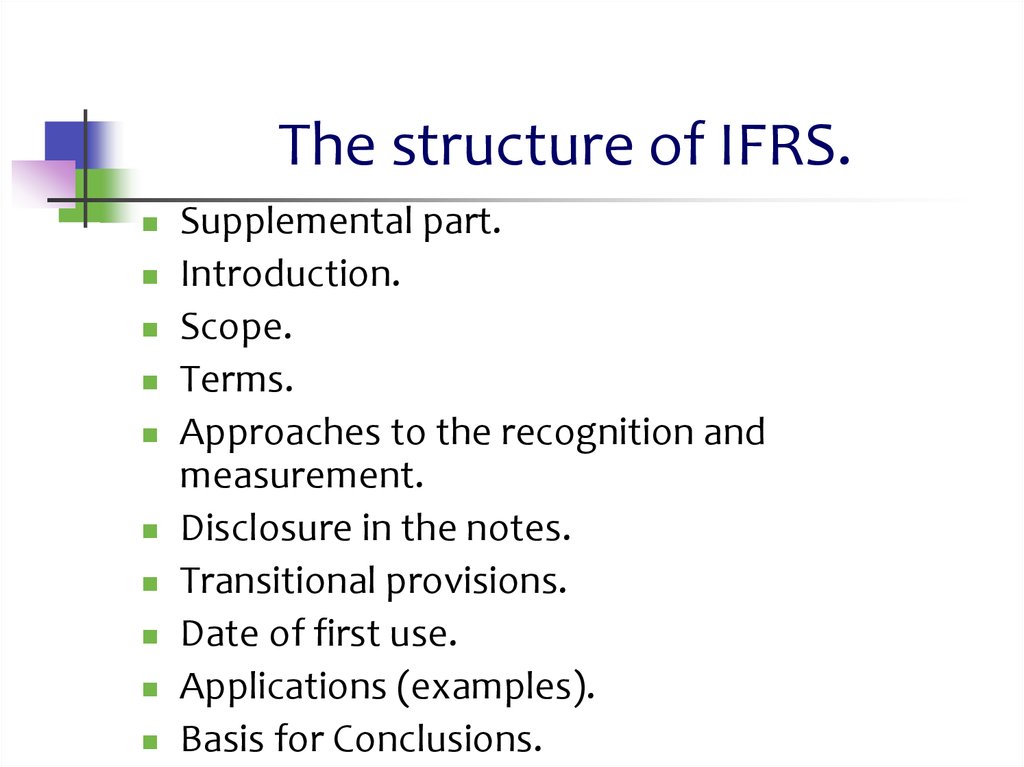

This data is reviewed by management, investors, and lenders for the purpose of assessing the company’s financial position. This financial statement shows a company’s total change in income, even gains and losses that have yet to be recorded in accordance with accounting rules. Investors and lenders can use this information to get a more detailed and comprehensive picture of a company’s financial health. Not all financial statements are created according to the same accounting rules. The rules used by U.S. companies are called Generally Accepted Accounting Principles, while the rules often used by international companies are International Financial Reporting Standards (IFRS).

What are the Four Basic Financial Statements?

It is important to note that the balance sheet represents a snapshot of the company’s financial position at a specific point in time. The income statement, also known as the statement of operations or profit and loss statement, is one of the four main accounting statements prepared under GAAP. It provides a summary of a company’s revenues, expenses, gains, and losses over a specific period, bookkeeping questions such as a fiscal quarter or year. The income statement helps stakeholders understand the profitability of the company’s operations and assess its ability to generate profits. These four accounting statements are interconnected and provide a holistic view of a company’s financial performance, position, and cash flows. They each serve a unique purpose and provide valuable information that helps stakeholders assess the company’s financial health and make informed decisions.

The Financial Modeling Certification

This promotes transparency, accountability, and trust in the financial reporting process. Investors can make informed investment decisions, creditors can assess creditworthiness, and management can make strategic decisions based on a thorough understanding of the company’s financial situation. Investors and creditors use the cash flow statement to evaluate a company’s cash-generating abilities and its ability to manage cash effectively. Positive cash flows from operating activities indicate that the company is generating sufficient cash from its core operations how to find retained earnings to meet its obligations.

Essentially, it is a huge compilation of all transactions recorded on a specific document or in accounting software. For example, some investors might want stock repurchases, while others might prefer to see that money invested in long-term assets. A company’s debt level might be fine for one investor, while another might have concerns about the level of debt for the company. In the example below, ExxonMobil has over $1 billion of net unrecognized income. Instead of reporting just $36 billion of net income, ExxonMobil reports $37.3 billion of total income when considering other comprehensive income.

Analysts view the assets minus liabilities as the book value or equity of the firm. In some instances, analysts may also look at the total capital of the firm which analyzes liabilities and equity together. In the asset portion of the balance sheet, analysts will typically be looking at long-term assets and how efficiently a company manages its receivables in the short term. Also referred to as the statement of financial position, a company’s balance sheet provides information on what the company is worth from a book value perspective. The balance sheet is broken into three categories and provides summations of the company’s assets, liabilities, and shareholders’ equity on a specific date. Before lending you more money, the bank will want to know about your company’s financial position.

Breaking Down the Order of Financial Statements

The statement then deducts the cost of goods sold (COGS) to find gross profit. Say your popsicle cart blows a tire every other month, and you have to pay $50 in maintenance expenses each time. How often your bookkeeper prepares a balance sheet for you will depend on your business. Some businesses get daily or monthly financial statements, some prepare financial statements quarterly, and some only get a balance sheet once a year. Together, they give you—and outside people like investors—a clear picture of your company’s financial position.